Credit card penetration remains stubbornly low.To fully penetrate the Mexican market merchants need.

- Jaime González Gasque

- Jun 14, 2021

- 2 min read

Updated: Jun 23, 2021

Mexico’s e-commerce market enjoys uniqueadvantages. Thanks to its geographic location andinclusion in NAFTA, US multinationals have beenpresent in Mexico since the 1990s.

Mexican e-commerce got its start with globalcompanies taking pointers from their US-based headquarters, including Walmart, Sam’s Club, andHome Depot. Most recently, Amazon launched itsfirst international marketplace in Mexico, alongwith its popular Prime service. Walmart will openits own marketplace by 2018; MercadoLibre haslaunched its own premium delivery service.

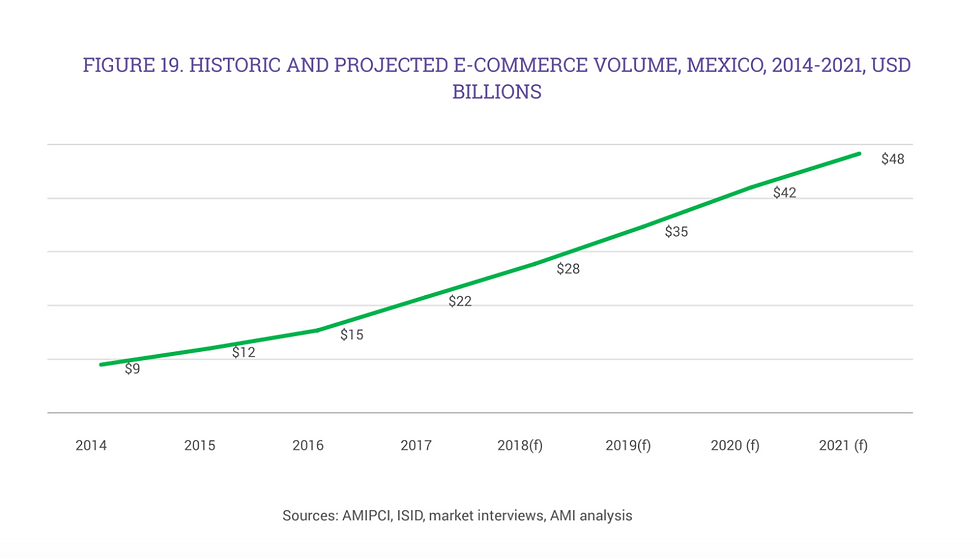

This competitive pressure will only serve to improve andbolster local e-commerce activity.By 2021, e-commerce in Mexico is projected togrow to nearly $48 billion, solidifying this country’sposition as an imperative market for expanding global merchants.

Mexico’s demographics highly favor rapid andwidespread e-commerce adoption, especially on mobile. Mexico has a high proportion of 18-40 yearolds, more than 80% of whom live in cities and 85% of whom own a smartphone. This population is online, plugged-in and ready to consume.

Access to payment methods is a challenge for this population, but smart merchants can overcome this by providing an offline-to-online ramp. Uber has had stellar success in Mexico City, thanks in part to launching its own debit card and cash acceptance to cater to the underbanked. Of course, Mexico faces its own challenges. Fraud is a serious problem, at an estimated 2% compared to <0.5% in the US. Perhaps more grave is the fear of fraud and the lack of consumer protections from banks. Many credit card-wielding Mexicans are loath to use their cards online; fraud is rampant and the chargeback process is grueling. Disputing a charge requires manually filing paperwork, obtaining signatures, producing invoices and hours of standing in line in addition to an overall feeling of being hoodwinked. For too many, shopping online is simply not worth the risk, unless the online retailer has taken the time to build trust. Partnering with local payment providers and offering local customer support is a must to win the e-commerce race in Mexico.

WHAT IS DRIVING GROWTH?

High smartphone penetration. E-commerce growth had a late onset in Mexico considering its

large population of 127 million. But smartphone and Internet penetration have now exceeded 50% and are attracting more e-commerce customers daily. Significant upgrades to local payment methods. Leading convenience store chain Oxxo has greatly improved its cash payment experience with its newly launched product, OxxoPay, which is now mobile-ready for consumers and provides real-time notification of payment completion to merchants.

Investment in fintech. From digital banking to online lending to various iterations of digital wallets, Mexico is experiencing a banking transformation, promoting the use of mobile devices for transactional purposes.

info@dlocal.com | www.dlocal.com

Comments